Right after registering, you’ll get a Virginia Tax account quantity for each tax style, a income tax certificate of registration (for retail income or use tax), and extra documents letting you really know what to file and when.

Do I would like a business plan for my LLC? Whilst you don’t need a business decide to form your LLC in Virginia, it’s still a good idea to have a single. Business plans can help you in some ways. Such as, this approach means that you can define That which you’re aiming to realize Along with the business.

Condition legal guidelines demand LLCs to possess a registered agent for support process. The agent functions as being a receiver of lawful papers with the LLC.

What level of funds contributions are made to the LLC via the parties, and when All those contributions are necessary to be made

A confined liability corporation (LLC) is actually a business composition which offers the advantage of constrained liability safety and flexible tax possibilities. Go through our phase-by-move guide beneath to learn how to get started on an LLC now.

Several small business proprietors Imagine they could do their own individual accounting and need to stay away from purchasing a professional services. However, selecting an accountant can help you save income, strain, and likely lawful difficulties In the end.

In contrast to a sole proprietorship, an LLC is a different entity from your business’s operator. Most sole proprietors would get pleasure from changing their sole proprietorships to LLCs simply because LLCs offer liability protection and are inexpensive to begin and sustain.

You are able to entry the conditions and terms of your sweep system at and a listing of application banks at . Be sure to Get in touch with customerservice@thread.financial institution with thoughts concerning the sweep application.

Supervisor-managed involves a large number of customers that are typically not associated with the everyday operations in the business.

Permit’s get to grasp your business improved: Reply a number of queries to decide which LLC offer meets your requirements.

What tax view construction should really I select for my Virginia LLC? That is a subject best to be mentioned that has a accredited tax professional. What we can say is site a large number of business owners choose a tax composition that features “pass-by means of” taxation.

Partnerships are qualified for pass-by way of taxation, which means profits could be passed by means of to every husband or wife’s personal earnings tax returns.

A registered agent is a necessity for all businesses in Virginia, but what occurs if yours resigns? In case you end website up in this example, then Virginia grants a 31-working day window to locate a new registered agent.

Restricted liability companies (LLCs) can defend your personal property and raise your business’s trustworthiness. An LLC is the simplest and most affordable authorized business entity to form and preserve.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Ross Bagley Then & Now!

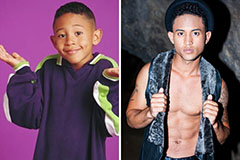

Ross Bagley Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!